We refinanced our mortgage from 4.5% to 3.5% 30 years fixed almost 4 years ago. Due to the COVID-19, the interest rate went down to the point that’s too good to pass, 2.1% to 2.5%. We would like to share the experience of refinancing online vs mortgage brokers. The online brokers have low overhead, therefore they can save us the money on points which most mortgage brokers make the money from. If you save 1% off the rate of a $500,000 loan, it’s $5000 and we do know on the average, the mortgage brokers must make at least $4000+ to keep their business in place. There are a few terms we’ve learned from all these refinances.

- No point, no fees: most of people misunderstand about these terms, these are only points and fees from the lenders, mortgage brokers.

- No Cost, no fees: There are costs that associated with the loan process that can’t be avoid: title insurance, appraisal, docs, tax, etc which are not from the lenders. When we want no cost out of pocket for the loan, these fees will be added to the principle of the loan.

- Most of people who refinance, the broker would add all the points and fees on to the new loan which sometimes the customers would over looked or didn’t really care due to the new low interest rate that results in low payments and interest savings.

- The customers should know the current balance of the mortgage, the rate, the remaining payments and the payment, because most of the time, the brokers will only display the new low rate, the new lower payment and the longest term possible although the new balance will be higher than the pay off $6-8k dependent upon the brokers.

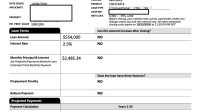

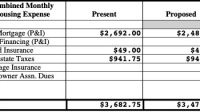

- In our case as an example, our current loan: $2692/month x 313 months remainder, the rate @ 3.5% and the balance $553,311.

- Our first proposed loan was 2.5%, 30 years @ $2217.81 with the loan amount of $561,300 which is about $8k over the balance. Yes, if you look at the numbers, we’ve saved almost $500/month, sounded good right? Not really, we’ve added 4 more years and $8k on the principle.

- Our final loan with a very nice licensed broker Wardell at loandepot.com that explained everything quite well which we thought it was the best and sound to do the refinance, he got me $5000 discount due to being returned customer from loandepot.com: new balance of $554,000, 25 years @ $2485/month and we have to pay out of pocket $2066 which a part of the total $2755 closing cost, nothing added to the new loan except ~$700. He saved must the appraisal of $500 by setting the value of the house below $1M although our house is estimated more, but what do we care about the estimate as long as it saved us money.

We’re not sure if this will be the last refinance we’re going to have, but chances are, not much lower than what we’re getting now. Now we have 25 years loan which we saved 13 months of $2692 and lower our payment $200, to us it’s a no brainer.

Many people are afraid of getting loan online because of the security and not seeing the loan officer face to face, but this day and age, we can do loan with a computer if we know how. Yes, choose the biggest online brokers and referral from friends and families. We know, when we get a loan of $553300+, if it’s $561300, it may not seem a big difference, but it’s $8000. We think it’s fair if mortgage brokers that have nice offices, face to face to take care of you 100%, make $5000+/- per loan, you pay for relationship, hand holding and attention. Bottom line, everyone needs to make a living, it’s up to us to be aware and ready for when the FEDS has the best rate and catch the opportunity.

Since our loan officer got my business due to being patient and knowledgable, we attached a link to his website , Wardell Smith 949-455-6212 if you want to give him a shot on your new loan. Remember, when you do things online, it doesn’t matter where he is, it’s the loandepot that counts.

- Fidelity CMA (Cash Management Account)

- Replace Rheem Electric Water Heater With Gas

- Light Fireplace With Pine Cones

- iBond 7.12% From TreasuryDirect

- Beware Of T-Mobile Sales Associates Promises and Actual Contracts