When I was single, the word retirement wasn’t in my dictionary until I got married and planned to have children. I became a worrywart about the old age here in America, the land of hunger is supposed to be non existent. I’m writing this post to remind the younger people like me who doesn’t believe in 401k, savings and investing, live pay check to pay check… “how can I be out of money when I still have many blank checks in my hands?” a joke that I found funny and sad.

As I understand the retirement system, if I work and pay taxes all my adult life, I can go to Social Security website to find out when I can retire and how much I can expect monthly, this money is supposed to be mine, I’ve been paying to it all these years. Many years ago, people believe that this money would be gone by the time of retirement for many younger people, it’s still not the case because younger people are making more money and pay more taxes. Anyhow, just in case to prepare for the worst scenario, NO social security checks coming in when I retire, 401k comes in place. 401k is retirement savings which is PRE-tax and can only be taken out at the retirement age without penalty, IRA is 401k for people who are self employed or roll over from old 401k companies. How much can I contribute in 401k yearly?

Yes, when I was young, single, I have no responsibility to anyone but me, I work and pay taxes, so, they have to pay me when I get old, that’s logic. But the older I get, especially with a family, kids, the thought of getting old and retirement did worry me and I took precautions when I decided to get married.

Living in Silicon Valley or California is extremely expensive, I can be irresponsible with myself when I’m young and single, but I don’t want to be irresponsible with the lives of my wife and my children, I had to marry someone who I love and have the same goal and values like me about building a family in Silicon Valley. I know, people get married for all sorts of reasons, you rock my world, can’t live without you, you can take care of my family, you can take care of me, you’re sweet, you’re handsome, you’re pretty… I can live well by myself with the salary of a professional, but building a family needs work, planning, love and sacrifice do come in place. I married my wife who’s also a professional and loved the family plan I had for us.

Our plan for building a family includes the retirement (heavily).

– Only spend money after maximum 401k contribution are in place for both of us, which means both of us have to be employed and work hard and smart to maintain employment.

– No new cars, new iPhones, text, data, cable TV until we can afford a nice house in a nice neighborhood for the children to go to the best school safely. We don’t need to show off to anyone since we have each other? It’s OK to rent a little condo, little tree for Xmas and save money for our house in the future. I learned to fix our old cars but paid for. We finally had our first smart phones this year after everything is going according to plan thanks to T-Mobile.

– In 4 years, we had our down payment for our first house in a great neighborhood – Still drive old cars – (amazing thing was I was $100k in debt and my wife still paying student loan when we got married) It does pay to work as a team.

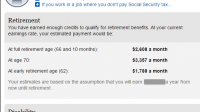

– This is about retirement – we’re looking at the future rates of inflation and current Social Security benefit for each of us – We will both receive over $2000 each when we retire = $4000/month, we would feel safe to have $7000/month for retirement = $3000 must be from 401k savings. If the official age benefit is much less than the next age benefit, plan to retire at the later year, use the 401k savings.

Assuming we would live 30 years after retirement since we’re healthy people, 401k must be: $36000 x 30 = $1080000.00

We don’t count the appreciation of the house because the market goes up and down, if it’s there when we retire, it’s the icing on the cake.

If we plan to divorce when we retire, then make sure we save more because it cost more to live as a single than a couple.

Since we have children, to maintain the goal of 401k, we have to save for their College funds and they’re expensive these days and the future for sure.

We don’t believe in College saving accounts for kids, some are very bad, we don’t want the kids to control the money when they hit their college age, we will control the money for their educations, if we can’t manage our own money and save for the kids future, it’s too bad.

Average public Universities cost = $35k/year x 4 = $140k per child.

Average Master programs = $80k, we will try to save for them to go if they want to.

The cost of college is high, the kids should understand going to school is for a career and not for being educated, yes, but for later. Many kids are idealistic, but not practical. I remembered I loved to draw and do draw very well, I always wanted to join Disney for sketching cartoons, but I had to go to art school, my father told me, get an engineering degree, then you can get art degree, your talent is always with you, you can join Disney anytime. Now I’m an engineer…

The Myth about going to costly famous private Universities for undergrads. It’s depend on what majors our kids choose, but they don’t pay when our kids graduated with art degrees. I know a BA from USC started with $40k/year ~$20/hr, the minimum wages in California is going up to $15/hour soon, it’s pitiful.

Since my company does match some money for 401k, it’s an icing on the cake, but the ESPP is the savings for our yearly vacations. Many people still don’t take advantage of Employee Stock Purchase Plan, most of the company offer minimum of 10% of total salary to save for buying company stocks at 15% discount, which means every 6 months, they take your 10% salary saving to buy the stock with the price of 85% of the market price which you can sell the next day for 15% profit, that’s not chump change either.

Many people I know, who went to college but for some reasons, never remember the economic 101, basic fixed cost and revenues.

Family finance is the same as any business – it has fixed cost and revenues (Income). People tend to live with the flow, afraid to put all fixed cost on paper – Am I already in debt waking up every morning?

When we get married to build a family, we need to know where to live and the cost of the area before we jump in the commitment, it’s a big one. Someone in the family must calculate and draw a plan for the family finance.

– If we add all fixed cost everyday, every month, every year, we will know how much we need to make to break even, or even save any money, if the numbers don’t make sense, either move to a different state or work more jobs for the income to go pass the fixed cost line. The more we make over the fixed cost, the more we can save and spend. Don’t make the fixed cost too high. When we signed a contract for 2 years with service providers to get the iPhone 6 Plus, we just added a fixed cost to our budget for 2 years (you’ve just financed $1100 – do you have extra $600 a year for that phone?), when we leased or bought a car for 3-6 years with payments of $500-700/month, we fixed ourselves with a cost for years… Remember, cars, phones, cable tv, are cash strapped stuff, they don’t appreciate only our home does, sometimes.

– California has the best weather, great place to live but it does come with a price, the cost of living in California is going through the roof, it’s time to check your finances, especially with your retirement – Have a plan, and have a great retirement life, although it may be years away, but time does fly and the kids are growing up fast, the scary thing is, we’re not getting any younger. It’s never too late to plan and 2 heads are always better than one.